How To Apply

To get pre-approved for a loan, whether it's a mortgage, auto loan, or personal loan, you typically need to provide the following information and documents to the lender:- Personal Information:

- Valid government-issued ID (driver's license, passport, etc.)

- Social Security number

- Contact information (address, phone number, email)

- Employment and Income Details:

- Employment history and current employer

- Income information (salary, wages, bonuses, commissions)

- 30 Day Pay stubs

- Tax returns (often for the past two years)

- Financial Information:

- Bank account statements (typically for the most recent 2 months)

- 2 Months Investment account statements (if applicable)

- 2 Months Retirement account statements (if applicable)

- Other asset information (real estate owned)

- Existing debt obligations (credit cards, loans, mortgages)

- Credit Information

- Authorization to pull your credit report

- Information about any bankruptcies, foreclosures, or late payments

For mortgage pre-approval, you may need to provide additional documents such as property information, down payment and loan amount.

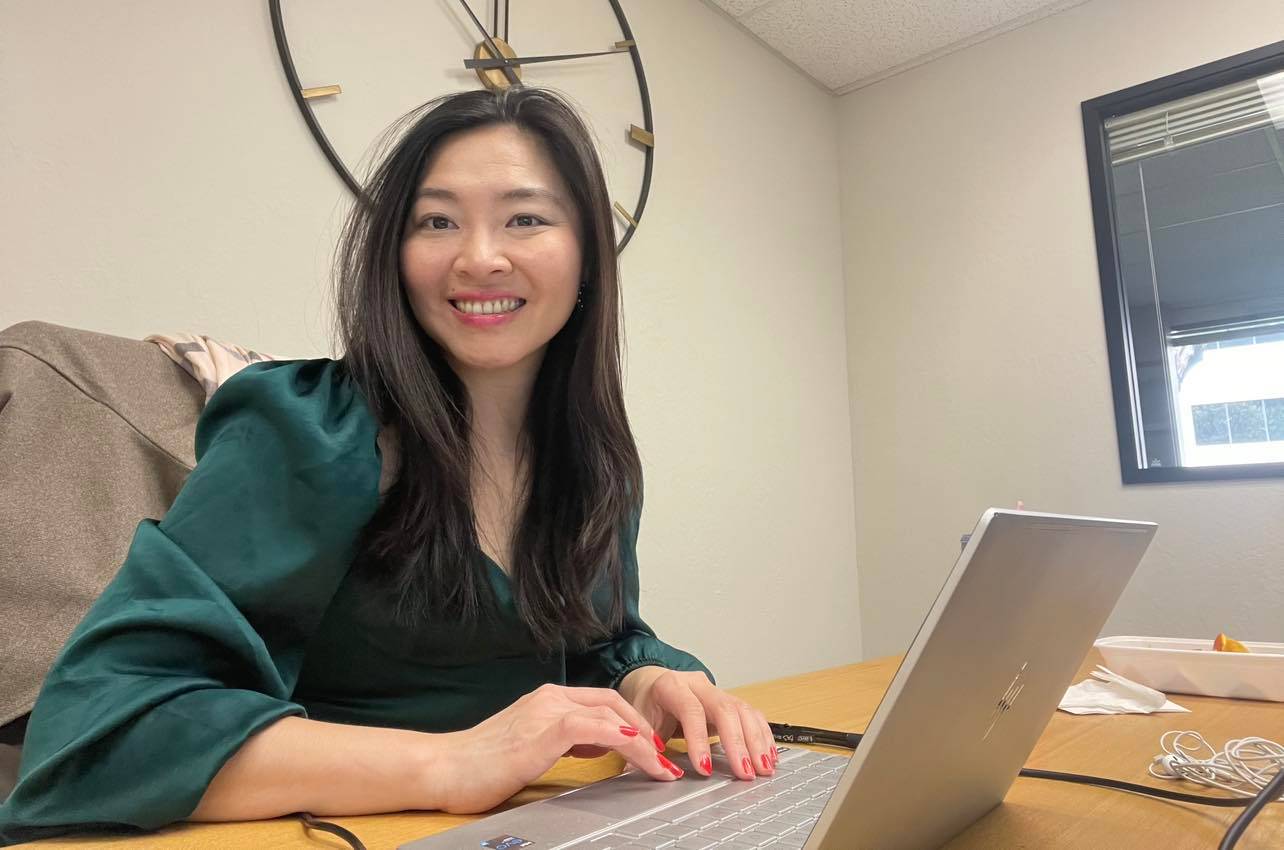

It's important to note that specific requirements may vary depending on the lender, loan type, and your personal circumstances. It's recommended to contact Tran Tran directly to get the precise list of documents they require for pre-approval. Additionally, be prepared to provide any additional documents or information that the lender may request during the pre-approval process.

Our Loan Programs

Get Pre-Approved

Apply Now

Refinancing Options